Withdrawing

Withdrawing customer funds is the act of redeeming funds from a customer’s brokerage account to a directed bank account.

Redemptions vs Withdrawals?

Redemptions and withdrawals mean the same thing and are used throughout the Guides and API Reference interchangeably.

Accounts have a defined amount that can be removed from the DriveWealth platform at any given time, known as the Cash Available for Withdrawal. This can be viewed in the Retrieve money details by Account API:

GET /back-office/accounts/{accountID}/summary/money

{

"accountID": "cc07f91b-7ee1-4868-b8fc-823c70a1b932.1407775317759",

"accountNo": "DWBG000052",

"tradingType": "CASH",

"updated": "2022-12-25T18:41:32.440Z",

"cash": {

"cashAvailableForTrade": 400.0,

"cashAvailableForWithdrawal": 200.0,

"cashBalance": 400,

"noBuyingPowerReason": [],

"cashSettlement": [

{

"utcTime": "2021-04-26T13:30:00.001Z",

"cash": 200.0

}

],

"pendingPaymentsAmount": 0.00

},

...

}

This Account above has $200 that can be withdrawn.

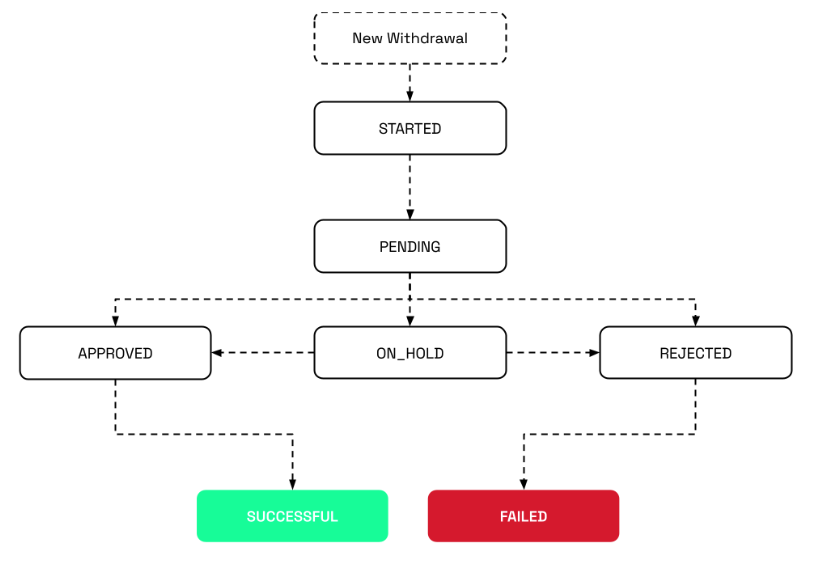

Withdrawal flow lifecycle

Withdrawals have a lifecycle in which they can inform a partner about the status of a particular Withdrawal. To understand more about the Withdrawal lifecycle flow see below:

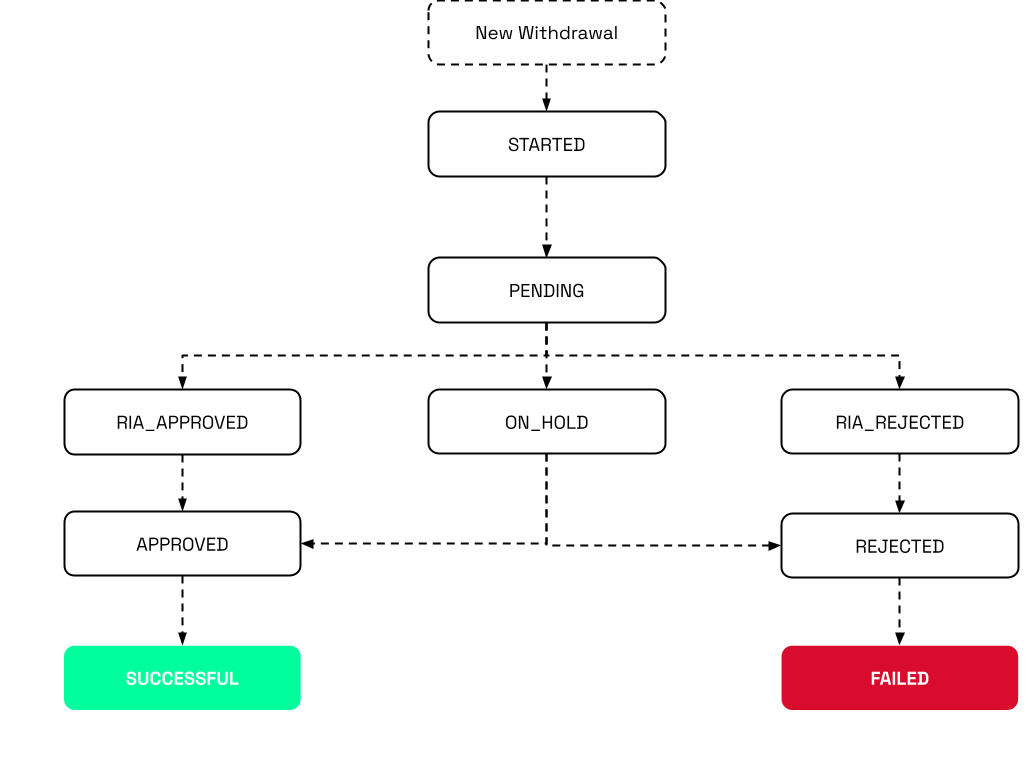

Advisory flow lifecycle

Managing advisory Withdrawals are a bit different than regular Withdrawals. In self-directed Accounts, it is expected that customers must sell positions to make cash available. In managed Accounts, a customer may be fully invested in securities without a way to create a sale order on their own.

If you're using DriveWealth's AutoPilot functionality, it will handle this process of selling securities to make cash available. When AutoPilot sees a withdrawal being requested, AutoPilot will automatically create sell orders during the next run to raise enough funds for the withdrawal based on the weights in the portfolios.

Without AutoPilot, the advisor would have to sell securities in the individual customer's brokerage account to raise the funds. Once the funds become available for withdrawal, the Advisory can then put in the Withdrawal request.

Justin wants to make a withdrawal of $250.00 from his robo-advisory brokerage account. He put his withdrawal in on January 3, 2023 before 10:00 AM ET. AutoPilot recognizes his withdrawal request and creates sell orders that morning at 10:30 AM ET. AutoPilot successfully sells enough securities to raise the $250.00 for Justin’s withdrawal on January 3, 2023. The platform will automatically wait for settlement day which will make the cash available for withdrawal (Trade Day + 1, aka T+1) which is January 4, 2023. The system will see cash available and will fire off the withdrawal sequence.

There is lead time on any AutoPilot-enabled account withdrawal is at least 1 business days, as cash must be first sold, then settled, before it can be withdrawn.

Individual withdrawals

An individual Withdrawal is a single movement of funds from a customer’s brokerage account directly to the originating banking account or to a destination explicitly specified by the customer.

| Withdrawal Type | Description |

|---|---|

| ACH | Automated Clearing House is an electronic funds transfer network that allows an integrator to facilitate the movement of funds. ACH is only available in the United States. |

| Wire | Wire, also known as a Swift, is an international electronic funds transfer network; allowing the transfer of funds between international banks. Swift is available world wide. |

| Paper check | A check is a physical document (normally in paper form) that orders a bank to pay a specific amount of money from a person's account to the person in whose name the check has been issued. DriveWealth will only issue physical checks to U.S. customers and businesses. |

Here is an example of using ACH to deduct a specific amount to a customer's bank:

POST - /back-office/funding/redemptions

{

"accountNo": "DWBG000052",

"amount": 125.92,

"type": "ACH_MANUAL",

"currency": "USD",

"details": {

"beneficiaryName": "Justin Smith",

"beneficiaryAccountNumber": "00257596002028990212396",

"beneficiaryAccountType": "CHECKING",

"beneficiaryRoutingNumber": "021000322",

"beneficiaryBankName": "Bank of America",

"beneficiaryBankAddress": "222 BROADWAY",

"beneficiaryBankCity": "New York City",

"beneficiaryBankProvince": "New York",

"beneficiaryBankZip": "10038",

"beneficiaryBankCountry": "USA"

}

}

Bulk withdrawals

Bulk Withdrawals are aggregations of Withdrawals from individual customers over the course of a day. Bulking lowers costs of transfers and decreases chances of failures.

The bulk withdrawal flow starts by indicating how much money will be transferred for each individual customer

POST /back-office/funding/redemptions

{

"accountNo": "DWBG000052",

"amount": 100.00,

"currency": "USD",

"type": "BULK_FUNDING"

}

This API will continue to be used throughout the rest of the day for more customers who wish to withdraw funds. Each time this occurs, DriveWealth updates a Settlement object, which details how much money in total will be expected to settle all of these withdrawals as debits.

POST /back-office/settlements/{settlementID}

{

"id": "sett_63ccb073-a7b6-4b33-af77-5baec5cc4494_settle-profile-usa_20221224",

"settlementDate": "2022-12-25",

"status": "PENDING",

"statusComment": "Finished processing breakdown",

"amount": {

"total": 5000.45,

"credits": 6000.45,

"debits": -1000

},

...

}

Managed accounts will follow a similar waiting period as described under Advisor Withdrawal Flow Cycle

Updated 3 days ago