Start Here

This document is intended to provide our counterparties with information to assist them with the onboarding and integration process. The information in this document is not intended to be the official operating procedures of DriveWealth and the information contained herein is subject to change. While DriveWealth will attempt to keep this information as current as possible, please check with your Partner Solutions contact with any questions.

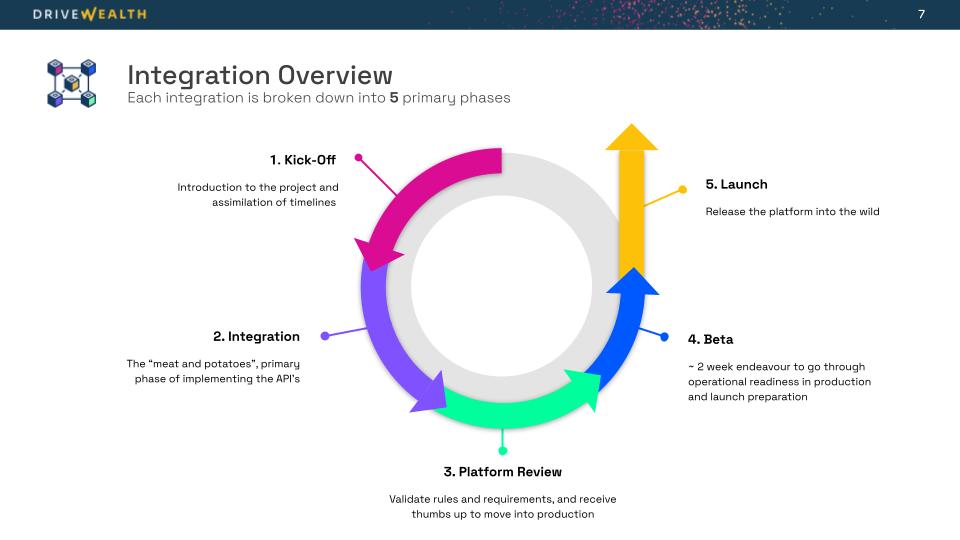

This integration overview explains the phases that will take your platform from the DW Test (UAT) environment to using real-world customer data in the DW production environment where your customers will have the ability to buy and sell financial instruments such as equities and digital assets as applicable.

The integration process is broken down into 5 sub-phases:

- Kick-Off: Introduction to the project and assimilation of timelines

- Integration: The "meat and potatoes," primary phase of implementing the APIs within the DW Test (UAT) environment

- Platform Review: Validate rules and requirements (orders, market data, and instrument data), and receive compliance approval to move into production

- Beta: Two week soft launch endeavor to go through operational readiness in production and launch preparation (review of reporting customer metrics and statements)

- Launch: Commercial launch of your platform

The integration process has two components to consider:

-

Technical Implementation of Your Platform - Your development team will work with the DW suite of APIs to complete the first four phases. During the Kick-Off phase, you will be provided with a detailed project plan, including an integration checklist of items to be reviewed and completed before production launch. After completing the integration checklist provided to you in the project plan, a platform review by the larger DW team will mark the end of the third phase and prepare your team for the beta and production launch phases.

-

Cooperative Project Management - In addition to the technical aspects of your integration, additional topics requiring partner input and consideration will include:

- Any fees or commissions to be applied.

- Will subscription (recurring) fees be applicable?

- Will certain exchange related fees be absorbed by the partner or passed through to customers?

- Obtaining partner information for statement branding and billing.

- Defining money movement workflows if not settled by the time the partner begins integration.

- Testing the transfer of funds between the partner (or partner's financial institution) and DriveWealth.

- Will the partner be using a 3rd party for market data? If not, which quotes will be used from DriveWealth?

- What order types will your platform support?

- Planning and accounting for administrative support on the partner's side.

- Reviewing and signing the Carrying Agreement.

- Sending DriveWealth a clearing deposit and trading deposit (if applicable).

Moving Into Production

Prior to receiving production credentials, a partner must ensure they have completed the following steps:

- Passed compliance due diligence

- Passed integration and application review

- Have a signed Carrying Agreement

- Have gone through operational readiness review

- Have sent in clearing deposit

Compliance Due Diligence

Prior to executing a clearing agreement for a new firm, DriveWealth conducts due diligence on a prospective introducing firm. This includes the financial, operational, credit and reputational risks to DriveWealth associated with entering into the arrangement.

NOTE:

DriveWealth can only enter a clearing agreement with a counterparty that is appropriately registered either as a Registered Investment Advisor (RIA) or Broker/Dealer (BD) in the jurisdiction in which activity is expected.

Once a Letter of Intent (LOI) is fully executed, the DriveWealth sales lead will send an email with DriveWealth’s initial counter-party/correspondent due diligence request and make an introduction to DriveWealth's compliance department.

The due diligence of the RIA/BD must be reviewed and approved by the CCO before:

- Technology can begin building any technology infrastructure to support the onboarding of the prospective counter-party;

- The carrying agreement can be executed.

However, while Due Diligence is in process, DriveWealth's Partner Solutions Group can begin meeting with the partner to scope out the requirements for the eventual technology build and support. In addition, legal and the sales leads can work on the terms for the carrying agreement.

Integration and Application Review

Partners should plan to have their integration and application review completed roughly two weeks prior to the expected soft launch date.

-

It is recommended that the partner sends DriveWealth wireframes and user stories prior to review to expedite the process.

-

DriveWealth does not implicitly provide recommendations during this process, but may require the partner to make updates/changes to their application.

During this review the Partner Solutions Group will be checking the application for the following (your integration team member will cover all points in the project plan):

- All required onboarding questions have been asked

- All required DriveWealth disclaimers and disclosures have been displayed

- Customers are able to attest or not attest to the disclaimers and disclosure they were provided

- Customer is provided with W9 or W8-BEN text language to satisfy IRS requirement

- Customer can generate their trade confirmations, monthly statements, and tax documents

- Customer’s DriveWealth account number is visible

- Correct account types are being generated in relation to the product being offered

- Market data is being used correctly

- Orders do not fail, and if they do, appropriate language is provided

- Charting and other performance reporting is accurate

- Funding options are correct and operational

After passing review by both Partner Solutions and Compliance, and a clearing deposit has been received, DriveWealth will then distribute Production keys. On average, it takes between 24-48 hours to distribute those keys.

DriveWealth requires that there is at minimum a 2 week period of internal partner friends and family BETA (soft launch) testing to ensure that everything is functioning as expected with real funds. Average BETA testing for partners is 2-6 weeks.

Launch Preparation Support

The first few weeks of being in production are the most critical. During this period, a partner is verifies that all logic and APIs transferred appropriately, real fund movements operate as expected, and any other technical items are addressed.

This period may require more communication with the Partner Solutions Group we are ready to support as necessary, in addition to scheduling and facilitating transfer to the DW Account Management Team for on-going operations.

Updated over 1 year ago