5B - Bulk Funding Overview

Phase 2 - Funding

API Reference

Settlement Report

SQS Reference

Task F1 - Review Bulk Funding Workflow

Review Bulk Deposit Flow

-

After establishing a US brokerage account, the next phase of steps involves funding the account, this will enable trading

-

Bulk funding is the process of aggregating customer money movement instructions into a single, once daily, Wire(preferably) or ACH transfer to DriveWealth. Bulk funding conceptually allows the Partner to make a deposit request which then increases the customers

cashAvailableForTradeinstantly, and then at the end of the day provides back a settlement breakdown indicating the exact dollar amount required to meet settlement -

This model supports Partners who DO NOT have a "digital wallet" model or want to keep cash in brokerage

-

Partners maintain all risk and responsibility for end customer funding

-

(Most Likely) Limited Purpose Margin Accounts (LPMA) - Customers can Incur Pattern Day Trade (PDT) Violations

- If Using Cash Accounts - Partner must Restrict Free Ride Sells - Reg T and Customers can Incur Good Faith Violations (GFV) in Cash Accounts

-

"Instant Trading Experience" - Customer is given an automatic increase in requested buying-power based on their API requested deposit (Since DriveWealth is receiving a single payment from the Partner there are no seasoning periods and funds to purchase securities become instantly available)

- At the end of every day (00:00 UTC), DriveWealth generates a settlement report containing the total dollar amount that must be sent by the Partner to DW and a full breaks down of all deposit transaction made over a 24hr cycle.

-

The Partner has real-time visibility into funded account balances and is able to ring-fence assets because they can hold/custody assets or are in partnership with a 3rd party banking service that can; this prevents the customer from spending funds that have been allocated for brokerage

Review Bulk Withdrawal Flow

-

Bulk withdrawal is the process of aggregating customer money movement instructions into a single, once daily, Wire transfer from DriveWealth. Bulk withdrawal allows the Partner to make a withdrawal request which then reduces the customers

cashAvailableForTrade,cashBalanceandcashAvailableForWithdrawalinstantly, and then at the end of the day provides back a settlement breakdown indicating the exact dollar amount which will be sent out on a per customer basis. -

Similar to Bulk deposit, Partners will maintain all risk and assume responsibility of moving money back to respective customer's external bank accounts.

-

At the end of every cycle (11:00AM ET), DriveWealth generates a settlement report containing the total dollar amount that will be sent by DW to a designated bank account and a full breakdown of all withdrawal transactions made over a particular 24 hr cycle.

-

The Partner has real-time visibility into the account balances

Settlement Requirements

-

API Call for Settlement Amount for both Deposits (prefix

DP_) and Withdrawals (prefixWD_) -

Deposits - Cash to Settle aggregate Customer Deposits needs to be delivered latest by T+2 (1 daily Wire payment sent to DW)

- DriveWealth expects a SINGLE payment to be made from the Partner. Individual transfers from customers are NOT accepted using this method

-

Withdrawals - DW sends out the Wires for the aggregated withdrawal amounts latest by 1:30PM ET

-

"Daily Travel Rule File" must be sent by the Partner to DW Operations for both Deposit and Withdrawal activity - This is a US Regulatory Requirement

Task F2 - Create a Deposit/Withdrawal via API

Bulk Deposits

-

When a customer makes a deposit request on the Partners platform a

INSTANT_FUNDINGrequest should be sent to DriveWealth for the matching USD amount -

Clients can immediately place orders after the posting of a deposit rather than waiting 1 to 2 business days for the deposit to settle; this creates a more real-time experience for end-users by enabling order placement without deposit processing delays

-

Funds are credited for buying power instantly

cashAvailableForTradeuponINSTANT_FUNDINGplacement -

cashAvailableForWithdrawalwill not increase until the settlement object is set to aSUCCESSFULstatus -

cashBalancewill not increase until the funds have settled with our bank

-

-

Deposits will automatically change deposit “statuses” to APPROVED, and then to SUCCESSFUL once the settlement object is marked as such.

SAMPLE DEPOSIT WORKFLOW

T+0: $100 Deposit request submitted

- cashAvailableForTrade: $100

- cashAvailableForWithdrawal: $0

- cashBalance: $0

T+0: Customer Purchases $50 of AAPL

- cashAvailableForTrade: $50

- cashAvailableForWithdrawal: $0

- cashBalance: -$50

T+1: Settlement Amounts have been settled & status marked SUCCESSFUL

- cashAvailableForTrade: $50

- cashAvailableForWithdrawal: $50

- cashBalance: $50

T+2: Customer Sells $50 of AAPL

- cashAvailableForTrade: $100

- cashAvailableForWithdrawal: $50($50 from the Sale of AAPL pending until T+4)

- cashBalance: $100

SAMPLE TIMELINE

T+0 at 3:00 PM EDT - $100 Bulk Funding Deposit

- Customer receives $100 increase to

cashAvailableForTrading

T+1 at 00:15 UTC

-

DriveWealth updates the settlement object to include aggregate deposit breakdown

T+1 -

DriveWealth updates the status of the settlement report to

SUCCESSFULon arrival of the funds(T+1 preferred) creating the underlying transactions in the customer accounts.

Impacts to Account Summary

- Exactly the same as the ACH option when a customer places a trade while using money in transit it's important to note that the

cashBalancedecreases by the total purchase amount

Impacts of a Restricted Status

- If a customers account is in a restricted status due to trading violations, the

cashAvailableForTradewill NOT increase based upon the deposit request. Since the account is in a restricted status, funds must be in a "good control" location (i.e. DriveWealth's bank account) in order for buying power to be provided to the customer. In this instance, Partners must wait until the settlement status of the deposit reaches aSUCCESSFULstate prior to seeing the buying power reflected in their brokerage account.

Bulk Withdrawals

-

When a customer makes a withdrawal request on the Partners platform a

INSTANT_FUNDINGrequest should be sent to DriveWealth for the matching USD amount -

The requested withdrawal amounts will be deducted from the customer's balances instantly

- Funds are deducted from

cashAvailableForTrade,cashAvailableForWithdrawalandcashBalanceuponINSTANT_FUNDINGplacement

- Funds are deducted from

-

Withdrawals will automatically change redemption “statuses” to APPROVED, and then to SUCCESSFUL once the settlement object is marked as such.

SAMPLE WITHDRAWAL WORKFLOW

T+0: Before Withdrawal request has been placed

- cashAvailableForTrade: $300

- cashAvailableForWithdrawal: $200

- cashBalance: $400

T+0: Customer Withdraws $50

- cashAvailableForTrade: $250

- cashAvailableForWithdrawal: $150

- cashBalance: $350

T+1: Settlement Amounts have been settled & status marked SUCCESSFUL

- cashAvailableForTrade: $250

- cashAvailableForWithdrawal: $150

- cashBalance: $350

SAMPLE TIMELINE

T+0 at 3:00 PM EDT - $100 Bulk Funding Withdrawal

- Customer's

cashAvailableForTrading,cashAvailableForWithdrawalandcashBalancedecrease by $100

T+1 at 11:00 AM ET

-

DriveWealth updates the settlement object to include aggregate withdrawal breakdown

T+1 -

DriveWealth updates the status of the settlement report to

SUCCESSFULafter we send the aggregate WIRE back (latest by 1:30 PM ET) creating the underlying transactions in the customer accounts.

Task F3 - Incorporate Bulk Deposits & Withdrawals Workflow in (UX/UI)

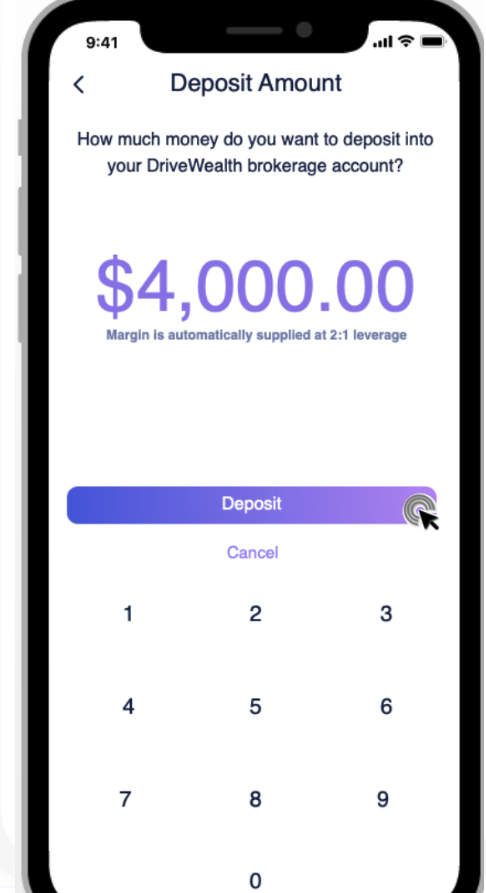

The primary way Partners display the UX/UI for bulk funding is by allowing the customer to enter a dollar amount they would like to fund their account with. Once the deposit request had been successfully made a redirect to a deposit overview screen is provided with the details of the deposit.

EXAMPLE - Deposit entry screen

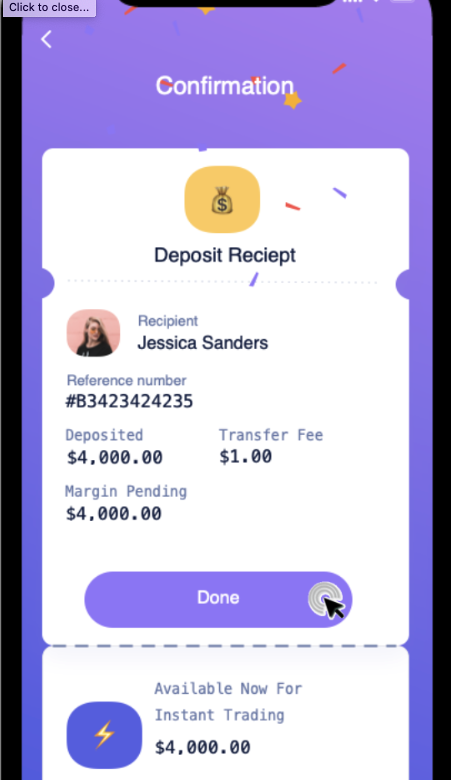

- After redirect from the deposit screen, you can provide the customer with the details of the successful deposit request

EXAMPLE - Deposit Details

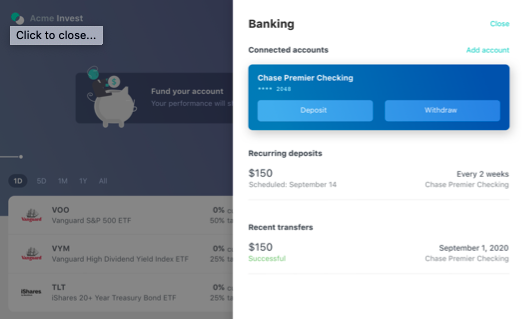

- The following screen will depict how we had recommended using the Get Deposit Details method to get back high-level details of all recent transfers

EXAMPLE - EXTRA DEPOSIT DETAILS

Task F4 - Funding Workflow Testing

Funding Screen Flow (UX/UI) is complete to include testing in the Sandbox Environment:

• Deposits

• Withdrawals / Redemptions

• Validate Cash balances

• Bulk Funding - Settlement Details have been pulled via API and validated (top of the page)

• Bulk Withdrawal - Has been tested and validated within the Bulk Funding Workflow (if applicable)

Task F5 - Incorporate Daily Travel Rule File

The file will be dropped to a Share File location that will be provided

The Partner's Operations team will send DW the following file daily for KYC/AML purposes in order to facilitate the Bulk Funding Workflow, format may be .csv and the following fields must be included:

- account number

- date of transfer

- Transaction Type

- batchCode (provided by DW)

- customer name

- customer address

- amount

- originating/beneficiary bank name

- originating/beneficiary bank address

- originating/beneficiary country destination

Task F6 - Complete Mandatory Operations Testing

Time Frames:

Deposits - 12:00AM - 12:00AM UTC

Withdrawals - 11:00AM ET

Bulk Funding - Instant Trading Integration

Operational Steps for Testing are in the Partner Project Plan

| TASK | DW | Partner |

|---|---|---|

| Partner Settlement Method Bulk Funding | Partner set for Bulk Funding: -Deposits -Withdrawals | Test in API |

| Due Diligence Review | -Commitment Fee & Deposit Amount Decision -Credit Line Established | Reviewed with Partner |

| ITA Trading Facility Agreement | Daily Procedures Reviewed and Agreement | Reviewed with DW and signed by both parties |

| ITA Deposit Fee Received | Deposit credited to Accounts | Partner remits Funds |

| ITA Trading Facility Account Established | Account created and ITA Deposit credited | |

| Virtual Account Instructions | Instructions provided | Test Deposit |

| Travel Rule File | Instructions provided template file file drop location | Partner sends test file |

Trading Facility Agreement - Information Regarding the Required Trading Deposit

- The Trading Deposit Required by DriveWealth is only intended to be used in emergency situations (ex: such as if the sending bank is having issues with sending wires due to a natural disaster or regional conflicts) it is not intended to be used if the Partner's operational capabilities cannot support given timelines and receipt of payment.

Definitions. “Buy Trade Funds” means funds necessary to settle a “buy” Transaction. “Sell Trade Funds” means funds owed to an Account from a “sell” Transaction. “T” means the then current date (EST time). T+1, T+2, T+3… etc. refer to the number of days after T. T-1, T-2, T-3… etc., refer to the number of days before T.

Trading Facility Purpose. DriveWealth will maintain the Trading Facility for Company as additional protection in the event that Buy Trade Funds are not received on or before the time specified by DriveWealth for a particular Transaction. In such instances where Buy Trade Funds are not timely received, DriveWealth may use the Trading Facility Deposit and the Trading Facility Line to settle applicable Transactions.

Trading Facility Line. The initial “Trading Facility Line” provided by DriveWealth to Company is stated in the Fee Schedule. The Parties agree to review the Trading Facility Line on an ongoing basis to determine whether adjustments are necessary.

Facility Deposit. Company will be required to make an additional Facility Deposit. The Facility Deposit may be used by DriveWealth as necessary to settle Transactions in instances where Buy Trade Funds are not otherwise timely received by DriveWealth. The Company will be required to return the Facility Deposit to its set amount in the event of use. The Facility Deposit will be treated pursuant to the same terms as those covering the Clearing Deposit described in the Agreement; provided, however, that the Facility Deposit may only be used in connection with the purposes described in this Trading Facility Supplement.

Commitment Fee. Company will pay an annual commitment fee as stated in the Fee Schedule. The commitment fee will be payable to DriveWealth prior to the implementation of trading pursuant to the trading flow stated in this Trading Facility Supplement. To the extent that there are increases to the Trading Facility Line, the corresponding incremental commitment fee payments will be due within fifteen (10) Business Days of the increase to the Trading Facility Line.

Use of the Trading Facility.

Drawdown. For any Transaction, if DriveWealth does not receive Buy Trade Funds prior to the time specified by DriveWealth, then DriveWealth may initiate a drawdown on the Trading Facility Line to cover amounts necessary to settle such Transaction.

Interest Charges. DriveWealth will charge Company interest if it is necessary to draw down on the Trading Facility Line at the rate provided.

Failure to Wire Funds. For any Transaction, if Buy Trade Funds are not received by DriveWealth by 12:00pm EST on T+4 and other accommodations have not been made and agreed to in writing, DriveWealth reserves the right to: (1) close Customer

Updated about 1 year ago