Create Portfolios

Phase 1 - Portfolio Construction

Task - Create Portfolios

The Autopilot 3 layer system allows Advisors to create proprietary funds and entire portfolios to cater to varying investment risk profiles and time horizons. After funds and portfolios are constructed, the system automatically rebalances to target weightings based on the frequency you set.

The three layers of portfolio construction

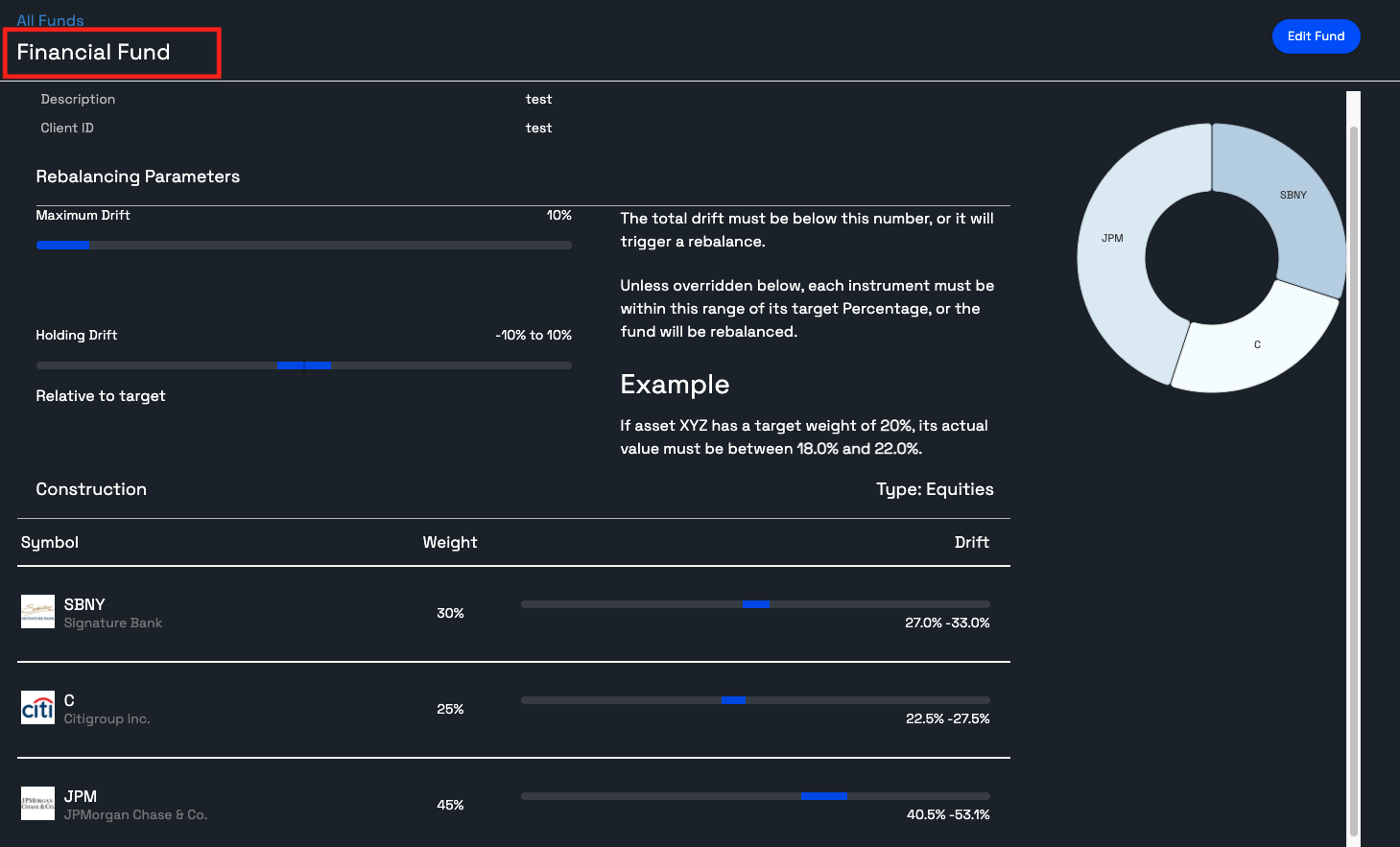

- Assets: individual securities in which clients will invest (stocks, ETFs, etc.)

- Funds: collections of Assets

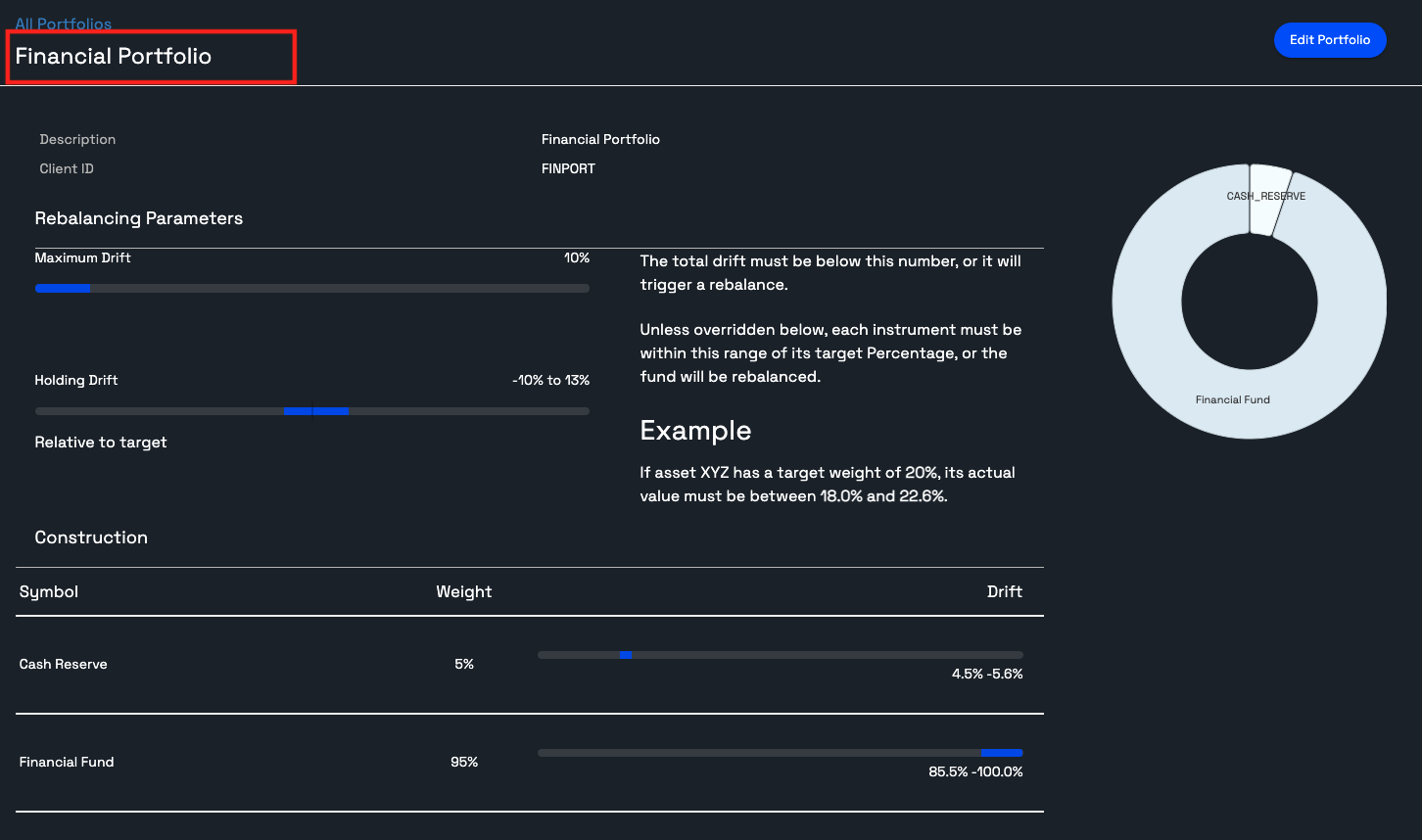

- Portfolios: collections of Funds. A Portfolio is what ultimately gets assigned to a client account

Create Proprietary Portfolios

After you define your Funds, you set up Portfolios that are made up of those Funds and/or individual investments, per the risk profiles and investment time horizons you cater to for your client base. A portfolio can be customized for an investor type or risk profile, or for each individual client. For conservative investors, you may choose to create a “Conservative portfolio” in which you invest more money in banking institutions than in technology companies. Just like Funds, Portfolios have target weightings and drift rules for each of their underlying holdings.

Simple Example of a Portfolio with (One Dummy Financial Fund) and a Cash Reserve:

Construct Client Portfolios

The Adviser has a few simple steps to construct a client’s portfolio:

- Select the investments

- DW recommends leaving at least ~2-3% of the total portfolio in cash to pay for any monthly fees without creating a situation where you have to liquidate the client’s positions to accommodate fees

- Investments can be individual stocks, ETF’s/ETN’s, ADR’s, mutual funds, proprietary funds or proprietary portfolios

- Assign a target weighting to each investment

- Set the drift parameters for each investment

- Select the frequency of the auto rebalance - daily monthly, quarterly, yearly, custom

- Frequency of Deposits and Withdrawals (See Money Movement for more details)

- Automatically invest regular deposits into the portfolio at set target allocations on a preset frequency (i.e. client adds $250 to the portfolio every paycheck)

- Automatically liquidate a percentage or dollar amount of the portfolio on a manual or scheduled basis (i.e. retiree needs to withdrawal $1,000 a month from the portfolio to pay household expenses, or $15,000 in August to pay college tuition)

Updated about 1 year ago