ROBO Overview

Phase 1 - Portfolio Construction

Task - Review Autopilot Outline

- Understanding and Designing your DriveWealth Autopilot Experience

Autopilot DriveWealth’s custom-built, proprietary Portfolio Management System (PMS), it is a series of advanced APIs that can simulate the core functionality of an order management system (OMS) for a Robo Advisor, this allows advisors the ability to create portfolios clients can automatically invest in (rebalancing to target percentages and timing intervals are all set by the advisor). Advisors will still maintain the ability to develop a fully native on-boarding experience within their mobile or web based application.

When designing portfolios the advisor will leverage DriveHub - the DW User Interface built to help advisors manage Autopilot and client accounts.

A.P. takes full advantage of dollar based investing leading to precise target allocations while complimenting the existing managed account infrastructure to include client sub accounts, bulk orders, and allocations:

- Allocate down to one millionth of a share in real time

- Auto-liquidate fractional remainders to remove inventory risk

- Configure portfolios once - target asset allocation, investment selection, drift parameters, rebalance frequency - then let the technology auto-rebalance back to target for every single client on the frequency you choose

- Set the Customer Risk profile - this is based on Partner’s proprietary risk-based model (Figure 14.1 below)

- Set target asset allocations per risk profile

- Select investments to construct diversified, balanced portfolios:

- Custom build from the DriveWealth product line-up - U.S. stocks, ETF’s/ETN’s, ADR’s, cash, money markets, mutual funds

- Construct your own customized “fund” based on themes (sector, geography, value-based, growth companies, high dividend yield, etc.) or risk profiles (conservative, moderate, aggressive, income-producing, long-term growth, etc. ) etc.

- Set drift parameters: can be set for individual securities or funds per customer

- Maximum Drift

- Holding Drift

- Individual Security Drift

- Auto-rebalancing

Client Risk Profile

The Partner will create the risk-based questionnaire and risk profile for their client base. The questionnaire will be owned and controlled by the Partner on their own front-end website or mobile application layer. You can, however, send the client’s investment profile information to DriveWealth via the API, which we will display in Partner Portal in the User Info tab in the “Investing Profile” section.

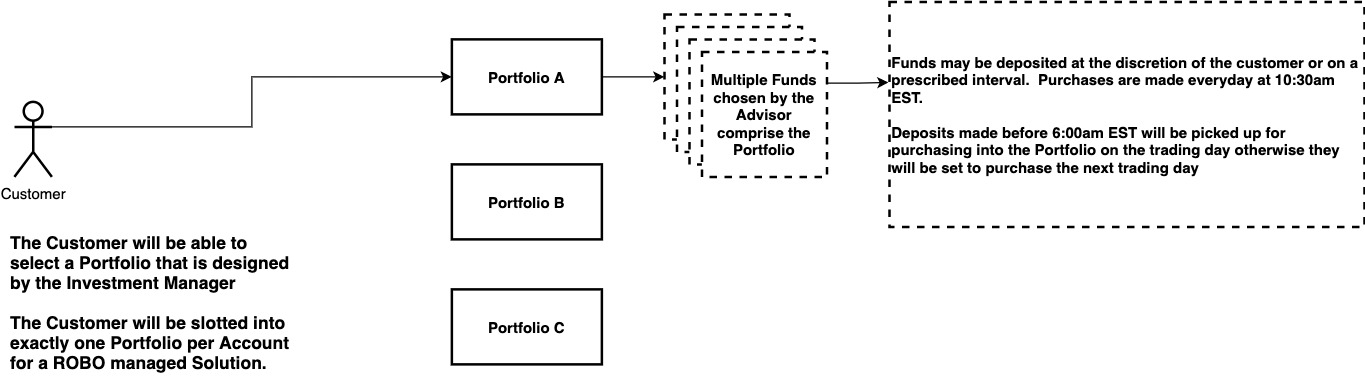

To begin a Partner only needs to:

- Onboard the Client

- Create an Account

- Assign a Portfolio to the Account

After the client creates an account and chooses a portfolio Autopilot will handle the rest. The system will monitor:

- Deposit and Withdrawal Activity

- Defined drift criteria for rebalances

- And provide full reporting for the advisor

Updated about 1 year ago